Accounting Manual

Financial Years

A financial year is used in government accounting, which varies between countries, and for budget purposes. It is also used for financial reporting by businesses and other organizations.

User can define the start & end of the financial year in details section.

Cost Centers

cost center, is a department within a business to which costs can be allocated.

Chart of Accounts

A chart of accounts is a listing of the names of the accounts that a company has identified and made available for recording transactions in its general ledger. A company has the flexibility to tailor its chart of accounts to best suit its needs, including adding accounts as needed.

Journal Types

An accounting journal is a detailed account of all the financial transactions of a business. It’s also known as the book of original entry as it’s the first place where transactions are recorded. The entries in an accounting journal are used to create the general ledger which is then used to create the financial statements of a business.

User is free to add journal types according to his business.

Procurement Taxes

User can add different taxes that will affect financial operations according to authority rules.

Sales Taxes

User can add different taxes types that will affect financial operations according to authority rules.

Check Books

A checkbook is a folder or small book containing reprinted paper instruments issued to checking account holders and used to pay for goods or services.

User can add checkbook using identifying bank & account name.

Then, he can add the sequence no of checks.

Settings

Link Functions to Journals

Users can assign/change journals for system functions.

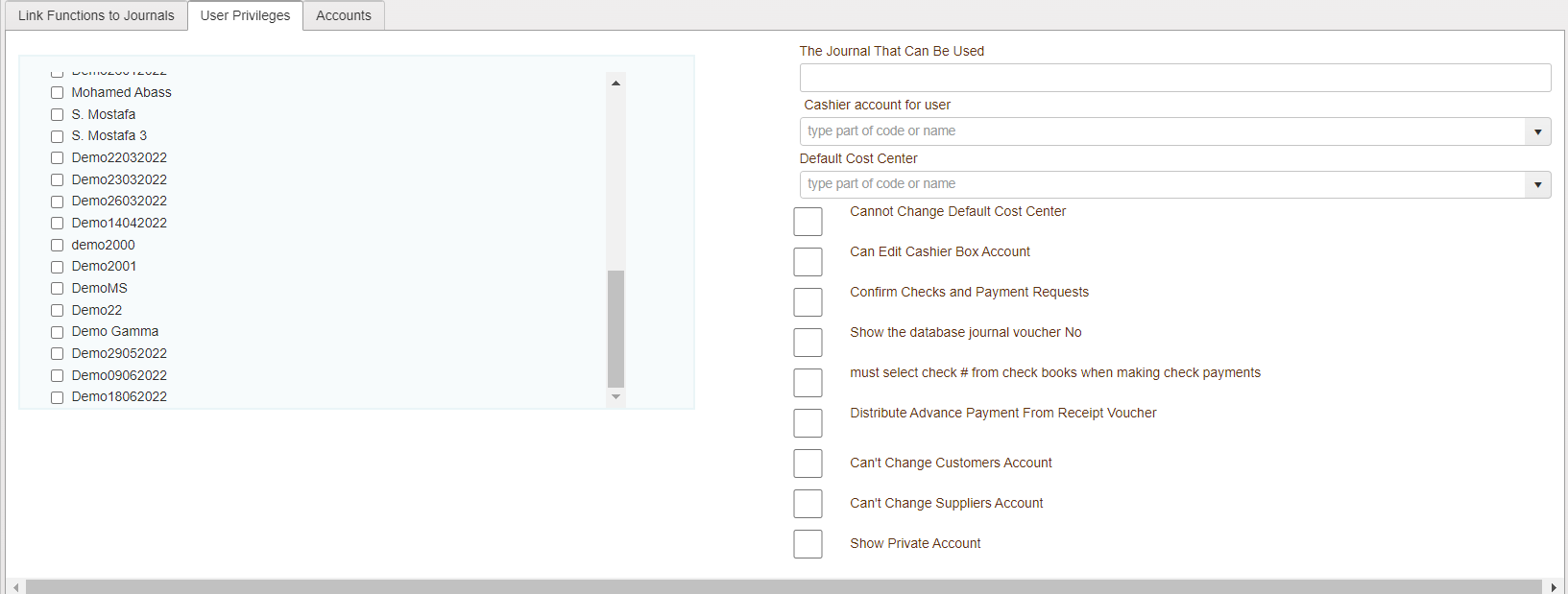

user privileges

User Privileges:

1. The Journal that can be used: Admin can limit some user's activity to some journals he can identify.

2. Cashier Account: Admin can define a cashier account that the user can deal with.

3. Default Cost Center: Admin can define default cost center, it will be loaded automatically on various system screens like CC, and Transportation.

4. Cannot change default cost center: If there is a default cost center, Admin can force the user to add records to the default one.

5. Can edit cashier box account: It's based on the previous option, If Admin has defined a cashier box account, he can force the user to use it or let him modify it based on this condition.

6. must select check number from checkbook: It forces users to choose from checks records that exist in the system, not write manually.

7. Distribute advance payment from receipt voucher.

8. Can't Change Customers Account: user can't handle the field of account of the customer, the system will create it automatically.

9. Can't Change Suppliers Account: user can't handle the field of account of the supplier, the system will create it automatically.

10. Show Private Account: user couldn't review the transaction in the report for the private account, that was activated as private from the chart of accounts.

Accounts

From this tab you can select:

the general accounts: cashier account, Profit & Loss Account,

Checks Setting: the , ,

Opening Balance

The opening balance is the amount of funds in a company's account at the beginning of a new financial period. It is the first entry in the accounts, either when a company is first starting up its accounts or after a year-end. ... The opening balance may be on the credit or debit side of the ledger.

PE Type

Prepaid expenses are future expenses that have been paid in advance. In other words, prepaid expenses are costs that have been paid but are not yet used up or have not yet expired.

Commercial Lease Rent.

Indemnity and Other Insurance.

Bulk Orders of Supplies.

Quarterly Estimated Taxes.

Retainer for Legal Expenses.

Anything Paid in Advance.

PE Agreement

PE Agreements is showing up all details regards prepaid expenses operation. It contains the parties, date, Number/value of payments.

PE Amortization

Prepaid expense amortization is the method of accounting for the consumption of a prepaid expense over time. This allocation is represented as a prepayment in a current account on the balance sheet of the company.

Journal Entries

A journal entry is the act of keeping or making records of any transactions either Economic or non economic. Transactions are listed in an accounting journal that shows a company's debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit.

Payment Voucher

A voucher is an accounting document representing an internal intent to make a payment to an external entity, such as a vendor or service provider. A voucher is produced usually after receiving a vendor invoice, after the invoice is successfully matched to a purchase order.

Receipt Voucher

A receipt voucher is a type of voucher which is typically issued by a certain business or an organization upon receiving payment in cash or check during a business transaction. ... Typically, a receipt voucher includes the names of goods and/or services, total amount, date, and signature of the issuer and recipient.

Debit Note

A debit note can be issued from a buyer to their seller to indicate or request a return of funds due to incorrect or damaged goods received, purchase cancellation, or other specified circumstances.

Credit Note

A credit note is issued to indicate a return of funds in the event of an invoice error, incorrect or damaged products, purchase cancellation, or otherwise specified circumstance.

Distribute Advance Payments

Advance payment is a type of payment made ahead of its normal schedule such as paying for a good or service before you actually receive it.

Check Request

Check-request is used for payments on many types of services.

Received Checks

User can record all received checks and their related operations.

Issued Checks

User can record all issued checks and their related operations.

Financial Estimate

The financial estimate is for information purposes only and is not mandatory for the applicant and aims at increasing the transparency on costs before the project starts.

Transfer Accounts Transactions

A transfer is a transaction that allows you to move all related operations from one account to another account.

Lock Journal Entries

Lock Journal Entries is used to prevent modifications or close old records like close previous financial years records.

Lock Payments & Receipts

User can lock payments or receipts vouchers due to different circumstances.

At first, user can search for voucher based on type and date (from-to). Then, based on search results, he can click lock button for locking records.

Close Financial Year

An accounting procedure undertaken at the end of the year to close out business from the previous year, carry forward balances from the previous year, and open posting accounts for the upcoming year. Year-end closing is part of a company's closing operations, and is used to create a company's financial statements.

Close Financial Periods

You can close a specific financial period to ensure that no more transactions are entered in that period.

Close Customers Invoices

The Close Invoice feature allows you to "freeze" selected invoices at any point after they have been created. When an invoice has been closed, you cannot make new postings to the invoice, edit transaction reference or supplemental information.

Close Suppliers Invoices

The Close Invoice feature allows you to "freeze" selected invoices at any point after they have been created. When an invoice has been closed, you cannot make new postings to the invoice, edit transaction reference or supplemental information.

Account Statement

An account statement is a periodic summary of account activity with a beginning date and an ending date. The most commonly known are checking account statements, usually provided monthly, and brokerage account statements, which are provided monthly or quarterly.

Account Summary

Account Balance/Period

Cost Center Statement

Trial Balance

A trial balance is a list of all the general ledger accounts (both revenue and capital) contained in the ledger of a business.

Income Statement

Balance Sheet

Budget vs Actual

Cash Inflow Forecast

Cash Outflow Forecast

Sales Tax

Purchase Tax

Product Balance (Cost)

Product Balance (Price)

Product Card (Cost)

Product Card (Cost/Price)

Product Profitability

Invoices not delivered